I got a glimpse into the future world of our robot overlords today. It was nervy at times.

I watched two robots go on stage at a tech event to “debate” the future of humanity with each other.

The robots in question are Sophia and Han, and they belong to Hanson Robotics[1], a Hong Kong-based company that is developing and deploying artificial intelligence in humanoids. The duo took to the stage at Rise in Hong Kong[2] with Hanson Robotics’ Chief Scientist Ben Goertzel directing the banter.

The conversation, which was partially scripted, wasn’t as slick as the human-to-human panels at the show, but it was certainly a sight to behold for the packed audience. Topics ranged from an early (and creepy) joke about taking over the world with a drone army, to ethics in robots and humans, robot job potential, and whether it is better to be rich or famous. There was even singing.

The event organizers claimed a world first for two robots talking on stage, and it isn’t difficult to imagine that it could become a more common sight in the future.

Indeed, this is just the start of Hanson Robotics’ ambitious plans.

Company CEO and founder Dr David Hanson believes robots will become commonplace in homes and other aspects of our daily life within the next decade. But the key to that progress is to equip them with the emotions and adaptability that is lacking from today’s crop.

“We’ve got these early uses but our aspiration is Data from Star Trek,” Hanson told TechCrunch on the sidelines of the event following the robot debate. “Data was the smartest member of the crew, he could do anything.”

“He certainly could work in a...

Read more from our friends at TechCrunch

Safe-haven demand for physical precious metals came in soft through the first half of the year as a rising stock market reinforced investor optimism toward the economy.

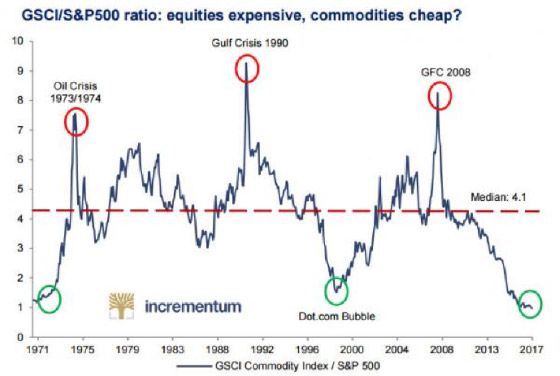

U.S. stocks are expensive by just about every valuation measure you can think of – price/earnings, price/sales, dividend yield, total market capitalization as a percentage of GDP, etc. Even Fed chair Janet Yellen remarked recently that equity valuations appeared “rich.”

The inverse of the extreme overvaluation in equities is the extreme relative cheapness of hard assets. Commodity indexes entered the summer at generational lows in real terms.

The perception has been that the world is awash in plentiful, cheap oil. Just a few years ago, with oil over $100 per barrel, the headlines blared warnings about peak oil and supply shortages. At major cyclical turning points in commodity markets, the news tends to reinforce whatever trends brought about major highs or lows in prices.

What investors need to keep in mind is that commodity markets are always cyclical in nature. No matter how bullish or bearish the outlook happens to appear at any given time, prices will eventually turn and trend in the opposite direction.

Oil and agricultural commodities perked up as summer officially began. Whether it’s the start of a major cyclical bull market remains to be seen. But the supply and demand fundamentals are setting up bullishly for commodities markets.

Lower Prices Stunt Production & New Shortages Push Up Prices

The cycle for any commodity follows the same basic pattern. When prices are low, production falls. As new supplies diminish, the market tightens and prices move higher. The higher prices incentivize producers to invest in production capacity and increase output.

Eventually, the market