If we must have an internet of things, it makes no sense to leave clothes out of the party. But clothes must be worn, washed, bunched up, and folded — it’s hard to make electronics that can survive all that. Plenty are trying, though; the latest attempt is from Harvard’s Wyss Institute, which uses a simple but effective layering method to make a durable, customizable flex sensor.

It’s quite basic, in a way: a material sandwich with layers of conductive fabric above and below a filling of silicone. When the fabric stretches, the silicone gets thinner and the conductive layers get closer together, changing their capacitance and producing a different electrical signal.

The way the layers are assembled, with the fabric laid on the liquid silicone and allowed to cure, physically locks the layers together. So the signal is more predictable and the fabric always returns to a base capacitance — meanwhile, even slight bending or stretching instantly produces a measurable change. It also works when chopped into arbitrarily sized and shaped pieces.

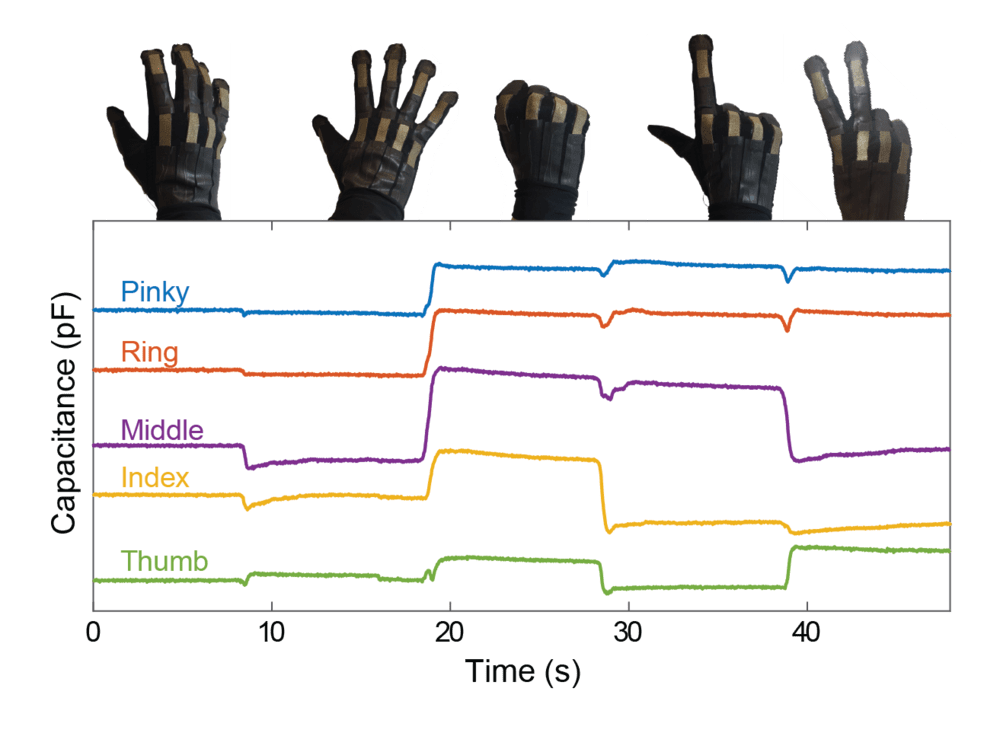

The team put together a glove using multiple pieces of the material, and found that fine movements of the fingers could be detected easily.

“Our sensor’s greater sensitivity means it has the ability to distinguish smaller movements, like slightly moving one finger side-to-side rather than simply whether the whole hand is open or clenched in a fist,” explained graduate student Vanessa Sanchez, co-author of the paper describing the material, in a Harvard news release[1].

“Our sensor’s greater sensitivity means it has the ability to distinguish smaller movements, like slightly moving one finger side-to-side rather than simply whether the whole hand is open or clenched in a fist,” explained graduate student Vanessa Sanchez, co-author of the paper describing the material, in a Harvard news release[1].

That could be a boon for all kinds of industries, from sports to virtual reality. Many current solutions for body tracking are rigid and weird, like exoskeletons that fit onto your knuckles or stopwatch-sized trackers mounted inside athletic garb.

...

Read more from our friends at TechCrunch

Safe-haven demand for physical precious metals came in soft through the first half of the year as a rising stock market reinforced investor optimism toward the economy.

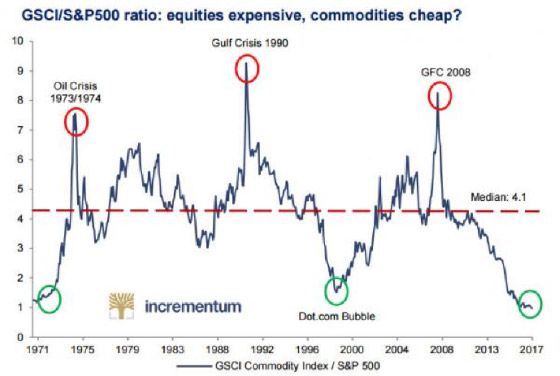

U.S. stocks are expensive by just about every valuation measure you can think of – price/earnings, price/sales, dividend yield, total market capitalization as a percentage of GDP, etc. Even Fed chair Janet Yellen remarked recently that equity valuations appeared “rich.”

The inverse of the extreme overvaluation in equities is the extreme relative cheapness of hard assets. Commodity indexes entered the summer at generational lows in real terms.

The perception has been that the world is awash in plentiful, cheap oil. Just a few years ago, with oil over $100 per barrel, the headlines blared warnings about peak oil and supply shortages. At major cyclical turning points in commodity markets, the news tends to reinforce whatever trends brought about major highs or lows in prices.

What investors need to keep in mind is that commodity markets are always cyclical in nature. No matter how bullish or bearish the outlook happens to appear at any given time, prices will eventually turn and trend in the opposite direction.

Oil and agricultural commodities perked up as summer officially began. Whether it’s the start of a major cyclical bull market remains to be seen. But the supply and demand fundamentals are setting up bullishly for commodities markets.

Lower Prices Stunt Production & New Shortages Push Up Prices

The cycle for any commodity follows the same basic pattern. When prices are low, production falls. As new supplies diminish, the market tightens and prices move higher. The higher prices incentivize producers to invest in production capacity and increase output.

Eventually, the market