Nintendo’s having a good year, and it looks like the latest Mario is set to make it even better. Super Mario Odyssey[1] is the fastest-selling Mario ever, in the U.S. at least, breezing past a million sales in under five days here and selling more than 2 million worldwide — and counting.

This should come as no surprise given the Switch’s swift sales and the obvious pent-up demand for a new Mario game. But it’s still nice to celebrate.

Reviews, including mine[2], have been reverent. The game is a joyous gem by nearly every estimation, and its Metacritic score (always to be taken with a grain of salt but a useful metric) is sitting pretty at 97, tied with the incredible Breath of the Wild for the highest-rated Nintendo game in years.

I asked Nintendo for a little extra info on the “in the U.S.” limitation; could it be that, for example, worldwide first-week sales of (say) Super Mario Galaxy on the Wii were higher? Nintendo declined to add to what it put in its press release[3], and I don’t blame them. I looked into it for a bit and really, even if that were the case, it would be comparing apples to oranges.

The Switch is in a unique position right now and one very different from where the Wii, Wii U or 3DS were in their first year. Mario and Zelda are both must-buys for the system and chances are a huge majority of players will end up buying them sooner or later, much like Ocarina for N64 or Super Mario Bros. 3 for the NES....

References

- ^ Super Mario Odyssey (techcrunch.com)

Read more from our friends at TechCrunch

If you are investing in either Bitcoin or Gold, it’s important to understand which asset is behaving more like a bubble than the other. While it’s impossible to understand how the market will value these two very different assets in the future, we can provide some logical analysis that might remove some of the mystery associated with the market price of Bitcoin vs Gold.

I’ve read some analysis on Bitcoin profitability and energy consumption that seemed unreliable, so I thought I would put my two cents in on the subject.

For example, many sites are using the Digiconomist’s work on Bitcoin energy consumption. However, I believe this analysis has overstated Bitcoin’s energy consumption by a large degree. According to the Digiconomist, Bitcoin’s annual electric use is approximately 24 TerraWatts per year (TWh/yr):

![]()

In a recent article that was forwarded to me by one of my readers, How Many Barrels Of Oil Are Needed To Mine One Bitcoin, the author used the information in the chart above to calculate the energy cost to produce each Bitcoin. He stated that the average energy cost for each Bitcoin equals 20 barrels of oil equivalent. Unfortunately, that data is grossly overstated.

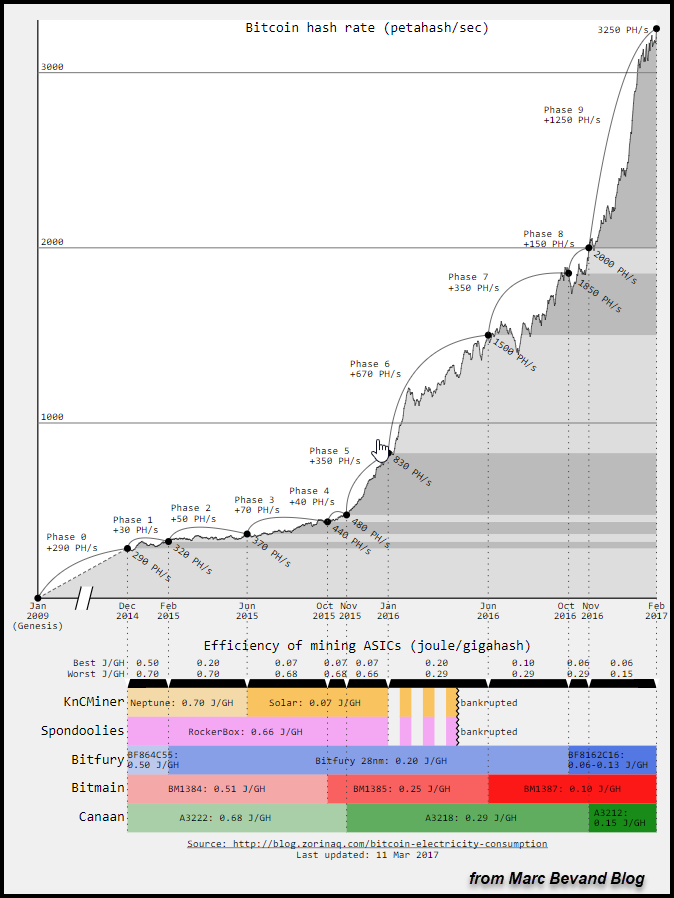

If we look at another website, the author explains in great detail the actual energy cost to produce each Bitcoin. According to Marc Bevand, he calculated on July 28th, that the average electric consumption of Bitcoin was 7.7 TWh/yr, one-third of the Digiconomist’s figure. Here is a chart and table from Marc Bevand’s site showing how he arrived at the figures:

This graph shows the increase in Bitcoin’s hash rate and the efficiency of the Bitcoin Miners at the bottom. If