Here’s the skinny: This computer is skinny. The MSI Trident 3 Artic is a gaming rig in a surprisingly small package. During testing the found the computer capable of running the latest VR hardware and games even though the tiny computer lacks the traditional cooling found on standard cases. The MSI Trident 3 Artic[1] is a gaming console killer.

Specs:

- Windows Home 10

- Intel Core i7-7700 3.6GHz 8M Cache

- H110 Chipset

- MSI GTX 1070 8GB GDDR5

- SO-DIMM DDR4 2133 MHz 16GB (8GB*2)

- 13.63″x 2.83″x 9.15″

- 6.9 Lbs

Review:

Gaming companies have long offered computers in different form factors. Generally, the bigger the case, the more powerful the computer. And that’s still the situation here in relation to the MSI Trident 3 Arctic. This is not the most powerful or well-equipped computer MSI offers. Instead, the company packaged a competent system into a package the size of an Xbox One. Basically, this is a computer built around an MSI GTX 1070 and that’s fine with me.

The case itself is the interesting part. It’s small-ish and is best served by sitting it vertically. If sat on its side, the cooling fans seem to struggle though I didn’t notice any graphical degradation. The design is striking. It looks like if the Nvidia Shield was a computer. And white.

Even though the overall goal was clearly to make a small computer, there are plenty of ports throughout the system. The front panel sports the usual assortment of USB and audio ports while the backside features nearly as many inputs and outputs as the Trident’s bigger siblings.

Even though the system is packed in...

Read more from our friends at TechCrunch

As the U.S. Stock Market Bubble continues upward toward a giant pin, there are some interesting developments that precious metals investors will find quite interesting. Yes, there’s still a lot of life left in the precious metals, even though pessimistic market sentiment has frustrated a lot of gold and silver investors.

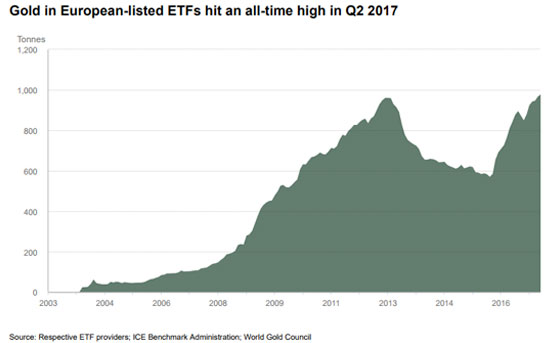

Also, even though precious metals investment demand in the U.S. has fallen 40+% compared to the same time last year, it continues to be strong in other parts of the world. For example, German physical gold bar and coin demand increased 8% in the first half of 2017 versus the same period last year, while U.S. fell by 45%. Moreover, flows into European Gold ETF’s hit a record during the second quarter of 2017:

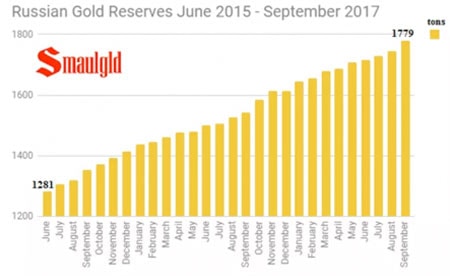

Now, if we look at what is going on with gold and Central Bank demand, Russia takes the first place. According to the article by Smaulgld, Russia Steps Up Gold Purchase With Massive Buy In September:

In September 2017, the Central Bank of Russia added 1.1 million ounces (34.2138 tons) of gold to her reserves, raising her total to 1779.119 tons or 57.2 million ounces.

Central Bank of Russia has added 5.3 Million ounces (approximately 165 tonnes) in 2017 through September.

If you haven’t already checked out Louis’s work at Smaulgld.com, I highly recommend you do. So, as the German public and Russian Central bank continue to increase their gold holdings, Americans have cut back considerably, or worse… have been liquidating. Furthermore, the U.S. gold market is suffering another supply deficit this year. As of July 2017, U.S. gold mine supply and imports totaled 288 metric tons (mt) while