The iPhone X is billed as a future-focused device with a lot of cutting edge tech, available at a premium. It kind of reminds me of the positioning of the original MacBook Air, or the new MacBook, when those two devices were first introduced – tomorrow’s tech, available today, but for a bit more money and with a few trade-offs as a result of being ahead of its time.

And the iPhone X does have trade-offs[1] – losing Touch ID is a blow, since it’s one of Apple’s strongest innovations in terms of convenience features for a mobile device, and one that has become essentially industry-standard across smartphone manufacturers.

There’s also the price: At $999 to start, this is the most expensive iPhone Apple has ever sold, and with upgraded memory options it’s easily more expensive than the cheapest Mac notebook in the lineup. Apple’s putting new meaning into the term “premium” when it comes to the smartphone category, even considering some recent high-priced device releases from competitors including Samsung.

These caveats might suggest that the true flagship of the moment is actually the iPhone 8 (and 8 Plus), which offer improved capabilities and hardware designs, but keep the price point the same as the 7 (and 7s) that preceded it. For a lot of users, that’s all that’s needed – better specs where it counts, and some great-looking photography features like the new Portrait Lighting mode on the iPhone 8 Plus[2] which compliments the existing Portrait Mode features.

And while it does look like a strong offering, there’s no question in my mind that the iPhone X is the true flagship, and the iPhone that Apple needed to field now to keep pace with the...

Read more from our friends at TechCrunch

The U.S. Government’s massive one-day debt increase had a profound impact on the amount of money it will have to fork over just to service its interest payment. On Friday, Sept 9th, the U.S. Treasury increased the total debt by a stunning $318 billion. Thus, the total U.S. Government debt increased from $19.84 trillion on Thursday to $20.16 trillion on Friday.

We must remember when the U.S Treasury adds more debt to its balance sheet; the government is now obligated to pay additional funds to service the interest on that debt. So, for each increase in U.S. Government debt, comes with it, an increase in its debt service payment.

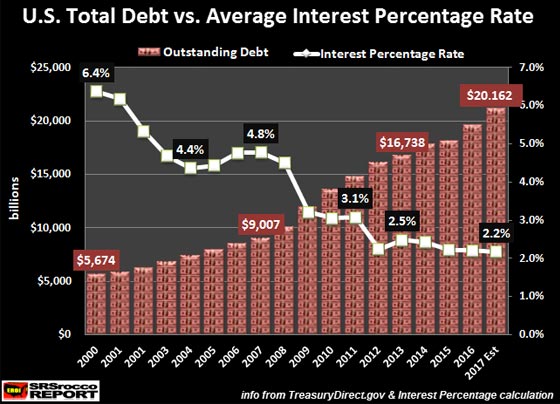

However, the U.S. Government has been able to control the rise in its annual interest payments by pushing the interest rate lower. For example, the average interest rate on U.S. Treasury debt in 2000 was 6.4% versus 2.2% currently. If we look at the chart below, we can see how the interest rate has declined as U.S. Government debt increased:

The RED DOLLAR bars represent total U.S. Government debt in billions of Dollars, while the WHITE LINE shows the annual average debt service interest rate. We can plainly see that total U.S. debt has nearly quadrupled from $5.6 trillion in 2000 to $20.1 trillion in 2017.

NOTE: I arrived at the average interest rate percentage figures by dividing the annual interest payments by the total outstanding debt.

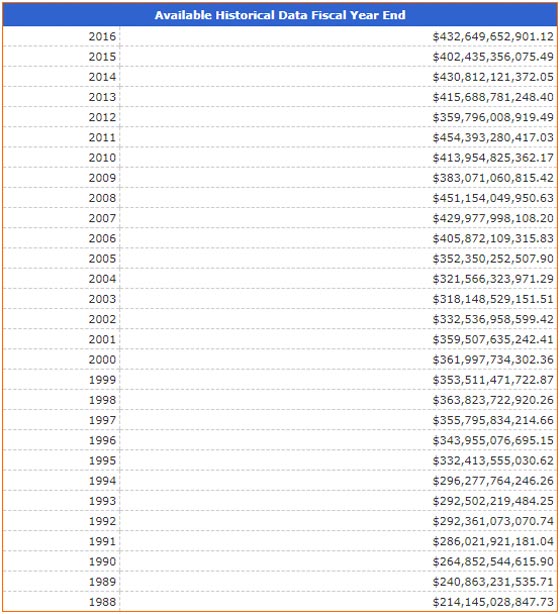

This next chart from the Treasurydirect.gov website lists the annual U.S. debt service interest payments:

(interest expense on debt outstanding, Treasurydirect.gov)

By taking the interest payment of $362 billion in