Ikea is getting into the domestic solar power generation and storage market in the UK[1], with new solar panel and home storage battery system products. The products include panels that integrated with existing roofing solutions provided by Solarcentury, a UK solar power company, which includes a 25 year guarantee on the panels themselves, as well as s six-year warranty on installation and every aspect of the system hardware.

The installations cost more than your average self-assemble coffee table, with prices beginning at the equivalent of just under $4,000 U.S. The battery storage component can work with the solar panel offerings provided by Ikea and Solarcentury, but are also offered standalone as add-ons for existing home solar installations. Those batteries will help boost solar usage rates as a fraction of total energy consumption for UK home owners, Ikea says, allowing the average home equipped with solar power generation to achieve nearly 80 percent solar usage.

Ikea entering the solar power market puts it in company with dedicated providers like Tesla, which offers home solar generation and storage solutions through its acquired subsidiary SolarCity, and via its Tesla Powerwall home battery storage product.

Ikea may not be offering a DIY solar solution like it does with its furniture assembly, but it is trying to make the process uncomplicated, which is in keeping with its broader mission. The home furnishings retailer says it’ll provide potential customers with everything they need to go solar as quickly as possible including a free quotation, a home survey, quotation approval and final installation.

If this takes off, it seems likely Ikea will look to expand the model elsewhere. That could mean partnering with different providers in different regions, so this could end up being an opportunity...

Read more from our friends at TechCrunch

In a better world we might expect:

- Individuals, corporations, and governments spend no more than their income.

- “Honest” money is used by all, has intrinsic value, retains its purchasing power and is not counterfeited by individuals or bankers.

- Governments and bankers support and encourage “honest” money.

Alas, we live in this world and must realize that:

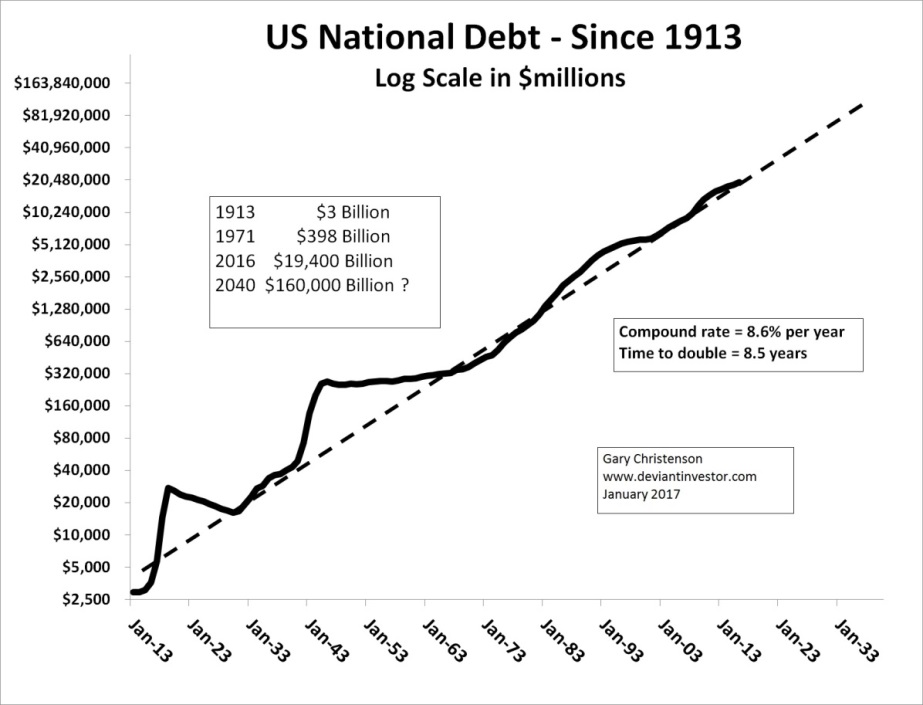

- Debt has increased rapidly for the past century. Example: U.S. national debt has expanded from roughly $3 billion to $20 trillion.

- Currencies are IOU’s issued by central banks who promote ever-increasing currency in circulation, expanding debt, and continual devaluations in purchasing power.

- The “fiat-currency-game” will continue until it implodes.

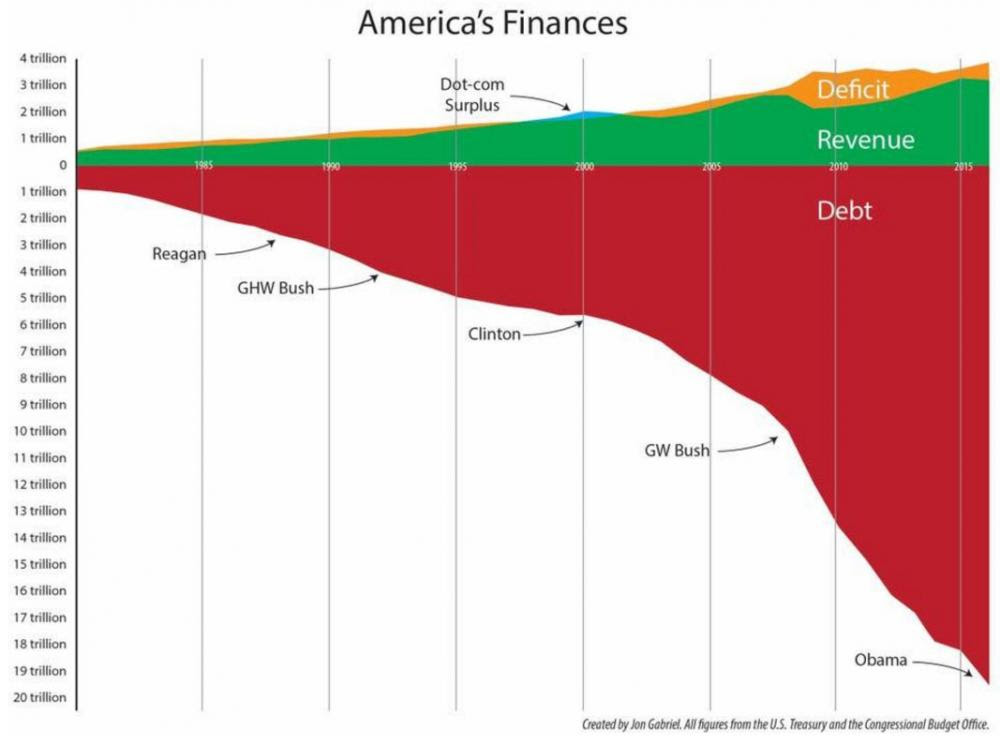

THE PROBLEM SHOWN IN ONE GRAPH:

Another Perspective on Official National Debt Increases Since 1913:

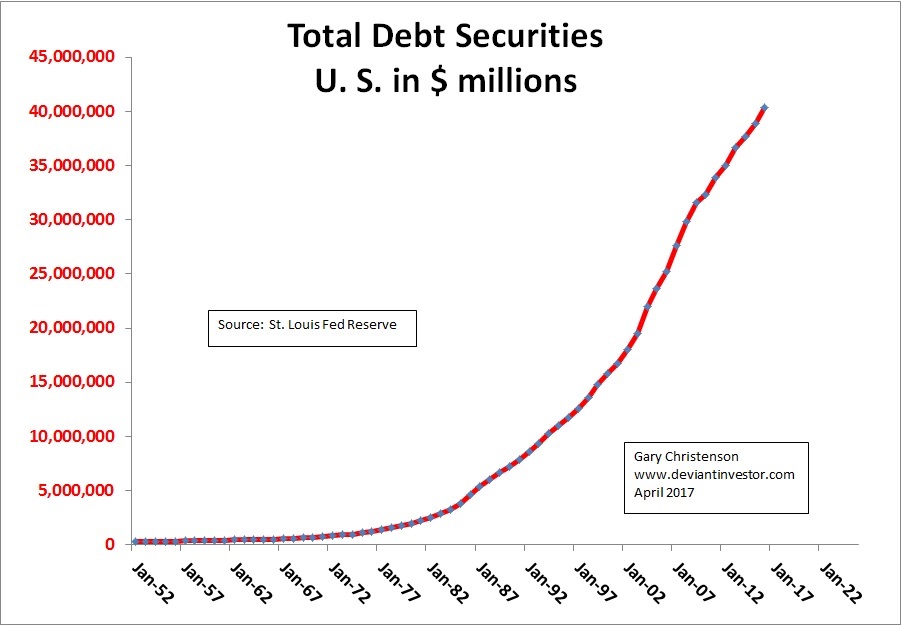

The economic world runs on debt and credit. Dollars are created as debt, so expect more debt, lots more debt. From the St. Louis Federal Reserve:

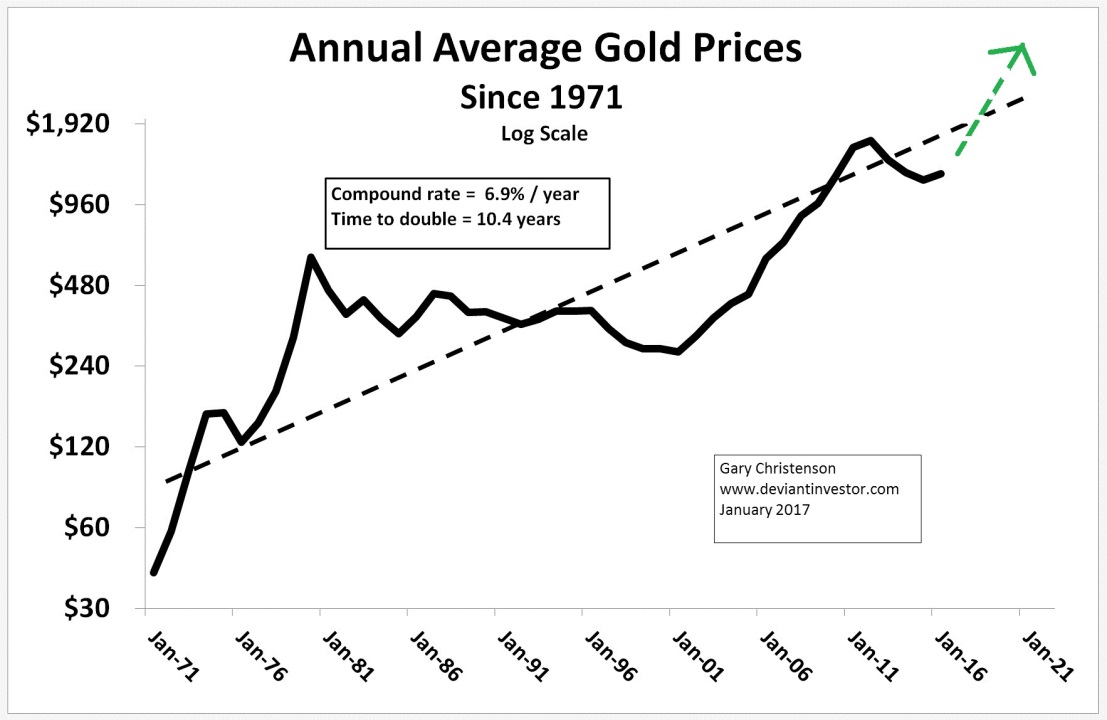

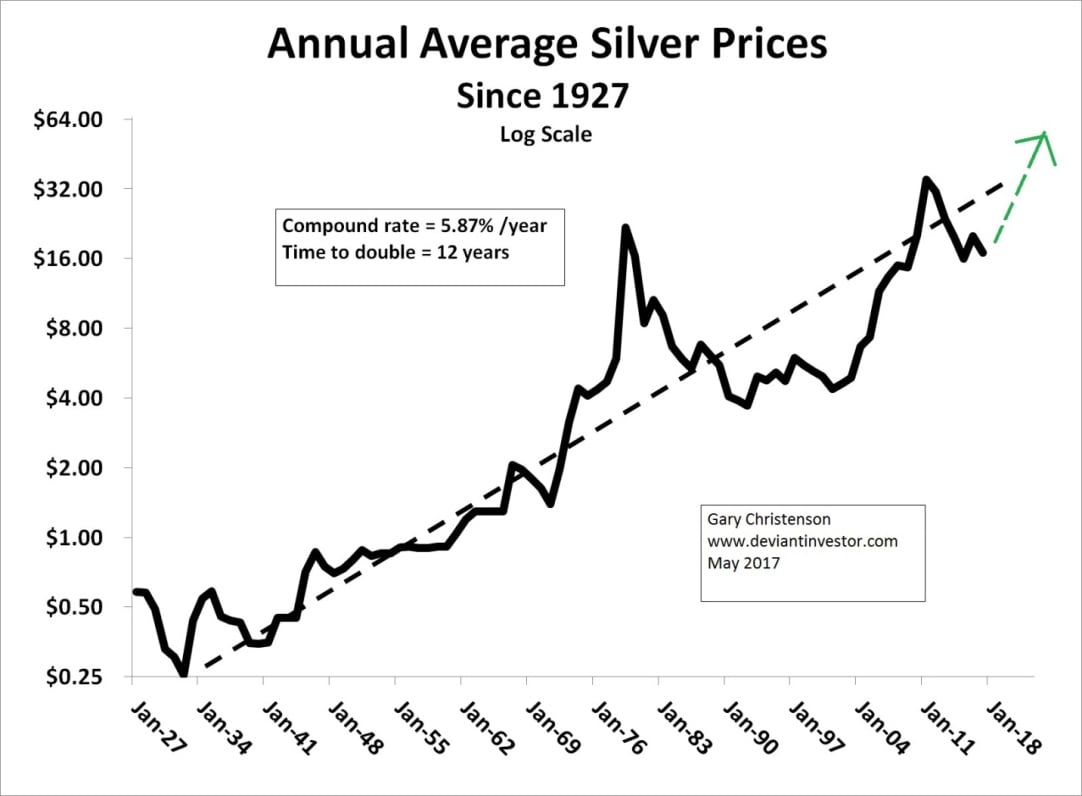

Gold & Silver Protect Purchasing Power

The Stock Market is Another Way to Protect Purchasing Power

Central banks and commercial banks create more dollars, yen, euros, and pounds, thereby diluting the value of all existing fiat currencies. Consequently consumers must protect their purchasing power.

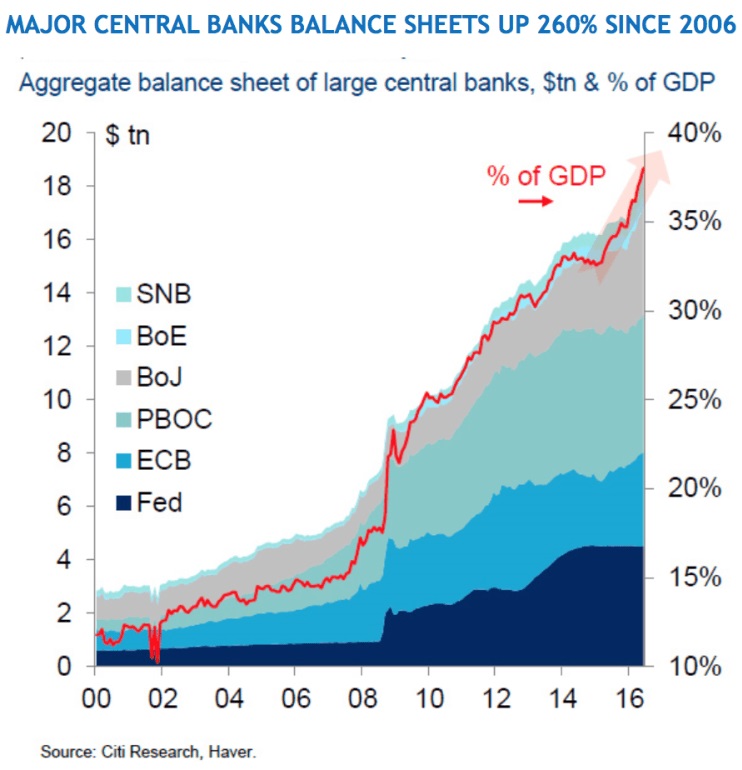

The government and central banking “borrow and spend” business supports and benefits the financial and political elite, so it will continue. For perspective on central bank “printing,” of their currencies from “thin air” consider this graph:

How do you protect your purchasing power? Stocks, bonds, real estate, silver, gold, and many others.

The problem with stocks – they are dangerously high.

From