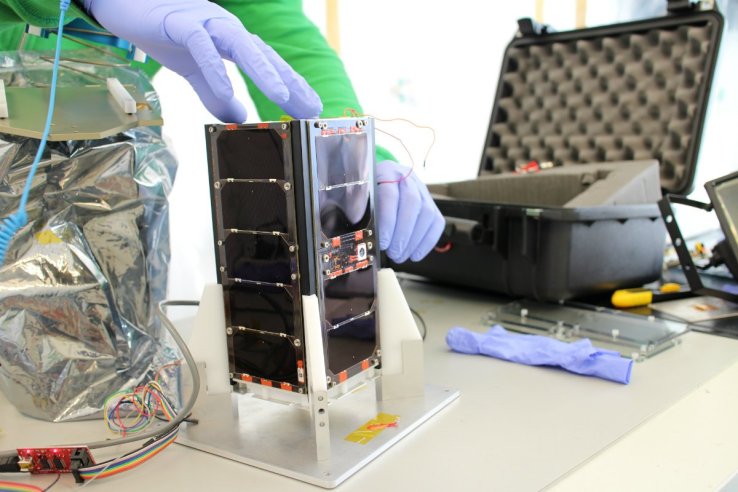

Space tech company Satellogic has raised $27 million in a Series B round led by Chinese internet giant Tencent, and with participation by CrunchFund (disclosure: co-founded by TechCrunch founder Michael Arrington). The company also launches its sixth micro-satellite into orbit on June 15, aboard a Long March-4B rocket that took off from Jiuquan Satellite Launch Center.

What Satellogic offers that’s unique is affordable, high-resolution imaging in a micro-satellite pllatform, with the ability to capture photo data of the Earth at 1 meter resolution. By comparison, Planet Labs’ Dove cube-satellite constellation offers 3-5 meter resolution.

Satellogic’s products also carry hyperspectral imaging, with 30 meter spatial resolution from orbit, something the company says is “unmatched” when compared to any currently orbiting satellites serving commercial or scientific missions. Hyperspectral imaging captures information from across the electromagnetic spectrum, which can help with prospecting for mineral and oil deposits, for example. It can also help with monitoring forestry, weather forecasting and climate change monitoring.

Founded in 2010, Satellogic raised a Series A round in 2015, also led by Tencent. Smallsats or CubeSats are a growing business, and should only become more interesting to commercial clients as costs from launch providers continue to drive down thanks to growing global competition....

Read more from our friends at TechCrunch

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Coming up we’ll hear part one of an amazing two-part interview with Jim Rickards, author of Currency Wars, The New Case for Gold and The Road to Ruin. Jim shares his insights on the Fed’s supposed plan to unwind its balance sheet and what it will mean for the economy and for gold prices. He’ll discuss some potential fireworks involving the U.S. dollar as it continues losing its reserve currency status. Don’t miss a must-hear interview with Jim Rickards, coming up after this week’s market update.

Beaten down gold and silver markets showed signs of recovering late this week as prices have risen above recent lows. Mining stocks are rallying strongly, pointing to upside potential for metals in the days ahead.

As of this Friday recording, gold prices come in at $1,256 an ounce, unchanged since last Friday’s close. The silver market is also flat on the week with spot prices currently coming in at $16.74. Platinum is off very slightly at $932 an ounce. While palladium, which was outperforming again through Thursday close when it posted a new high for the year, is off 2.5% so far today and is now down 0.5% overall this week to trade at $869.

All of the precious metals are outperforming crude oil this year. Oil prices took another dip earlier this week on concerns about over-supply. The glut has persisted despite OPEC’s vows to cut production.

The longer prices persist below $50 a barrel, the more non-OPEC producers will also have to hunker down. Many shale and offshore drilling projects that came online a few years ago are simply uneconomic at today’s prices.

By