I’m not a fan of educational toys. They’re usually either too educational or too toy-like and, in the end, kids get little education and little fun. The Code Kit from LittleBits[1] has changed my mind.

The Code Kit is very specifically targeted at classroom learning for grades 3-8 and costs $299. Why? Because it’s a bit more robust than the other coding kit LittleBits overs.

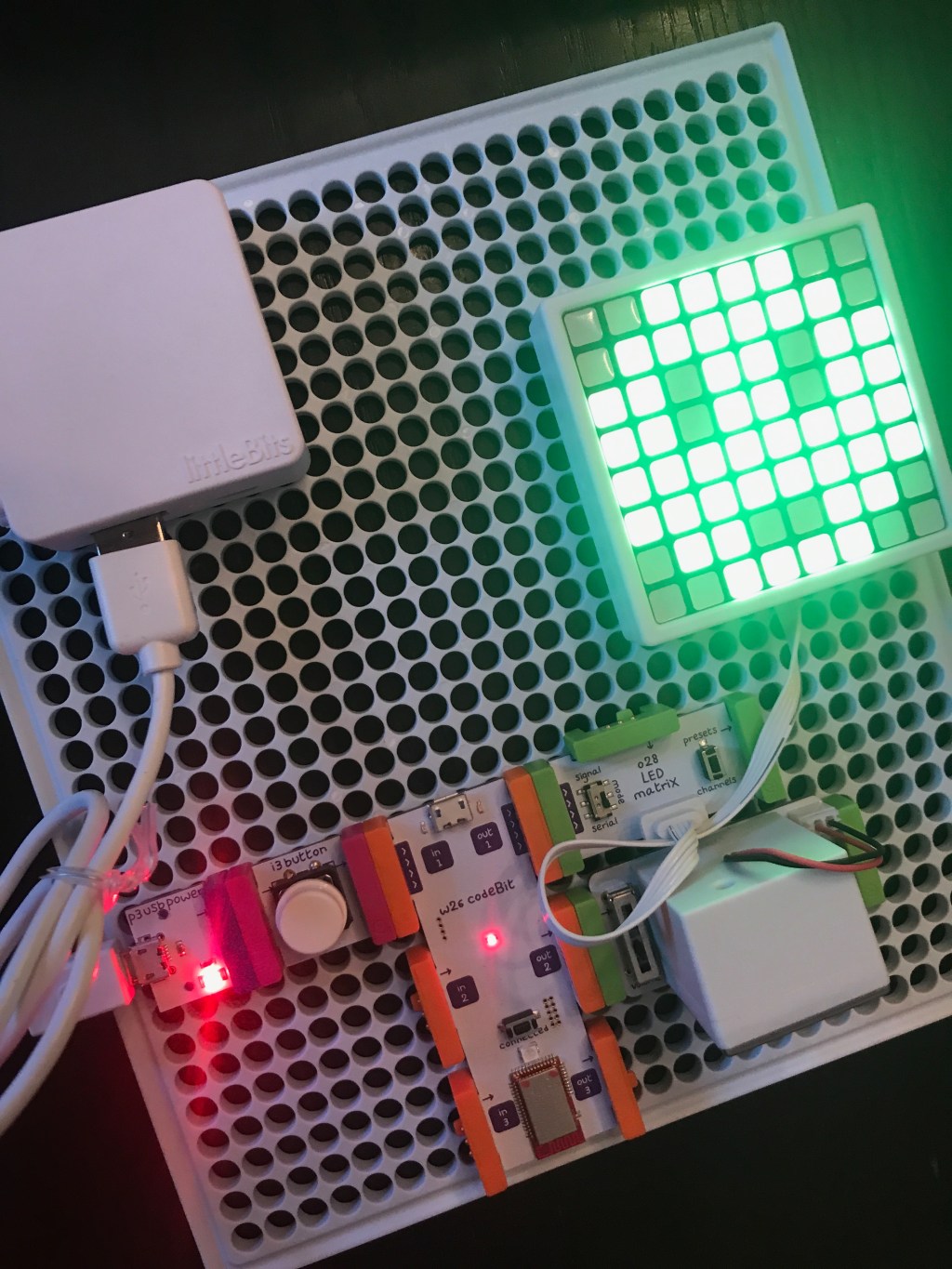

LittleBits is basically an electronics toolkit the consists of small components – batteries, speakers, switches – that connect together via powerful magnets. Things that connect will snap and stay together while things shouldn’t connect will repel each other. This means you can’t really short-circuit the limited power these kits have.

The Code Kit is an Arduino system in a box. It comes with a small rechargeable battery that can power an Arduino-based CodeBit with three inputs and three outputs. The CodeBot is wireless so you can program it via an included USB dongle.

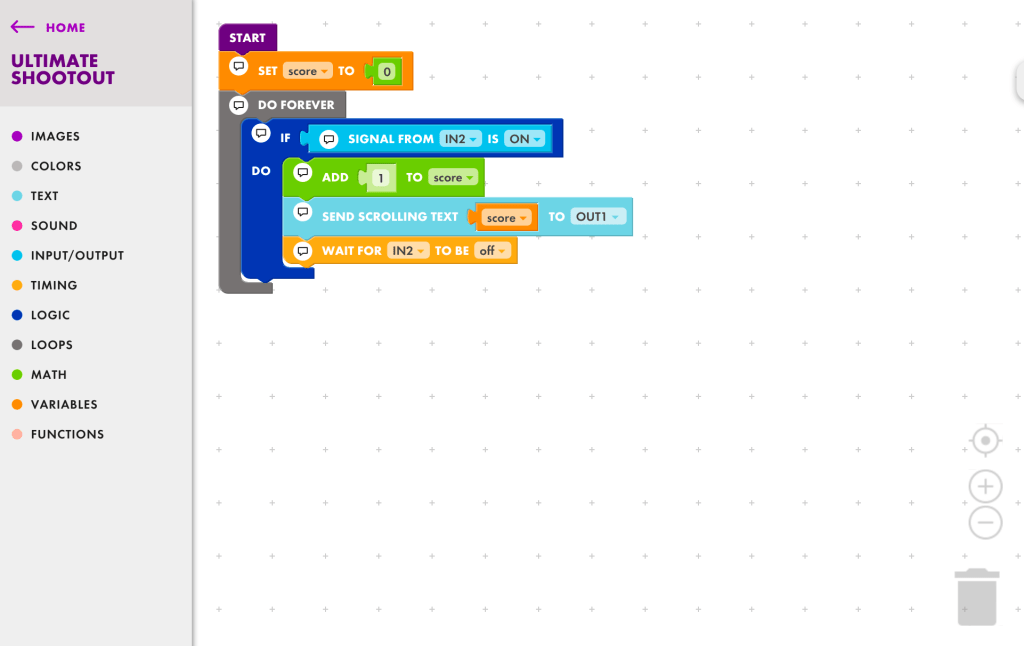

Programming the CodeBit is as easy as dragging and dropping in Scratch. I gave it to my kids and they were able to assemble the initial projects in minutes and, once I showed them the code, they were able to modify it and create their own games a half an hour later. Any teacher with a passing knowledge of simple programming could be up and running with this kit in a few minutes.

The thing I like most about LittleBits is the design. While breadboarding is fun, these little bits snap together quickly and easily and the addition of the CodeBit adds a great deal of functionality. I’ve never really liked the electronics kits that LittleBits sold – they didn’t do enough to be fun and were too...

Read more from our friends at TechCrunch

Several U.S. states and the federal government are hopelessly insolvent. It’s something many bullion investors have known for years.

The real question is when this reality will pierce the mainstream illusion that deficits, and the crushing pile of debt which accompany them, don’t matter. That moment drew closer last week when ratings agencies downgraded Illinois state bonds to one notch above “junk” status.

S&P and Moody’s dropped the state’s creditworthiness rating to BB+/Baa3 – the lowest ever for a U.S. state. Illinois currently has $14.5 billion in unpaid bills and a government deadlocked over forming a new budget.

That stack of bills represents a whopping 40% of the state’s operating budget. At the heart of Illinois’ problems are massive union pension obligations for retired government bureaucrats.

Sluggish economic growth, below par returns driven by zero interest rates, and the extravagant promises made to retirees created a funding gap that likely cannot be bridged. But the state looks like it will have to die trying.

Government union bosses and their supporters got pension obligations converted into a constitutional mandate in 1970. They made it so that certain benefits can only be adjusted in one direction – higher. Article XIII, Section 5 reads:

Membership in any pension or retirement system of the State, any unit of local government or school district, or any agency or instrumentality thereof, shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.

Adding that language was a neat trick, given the implicit mandate that the private taxpayers are permanently on the hook for these obligations – even as they enjoy no such guarantees in the face of their own impaired incomes