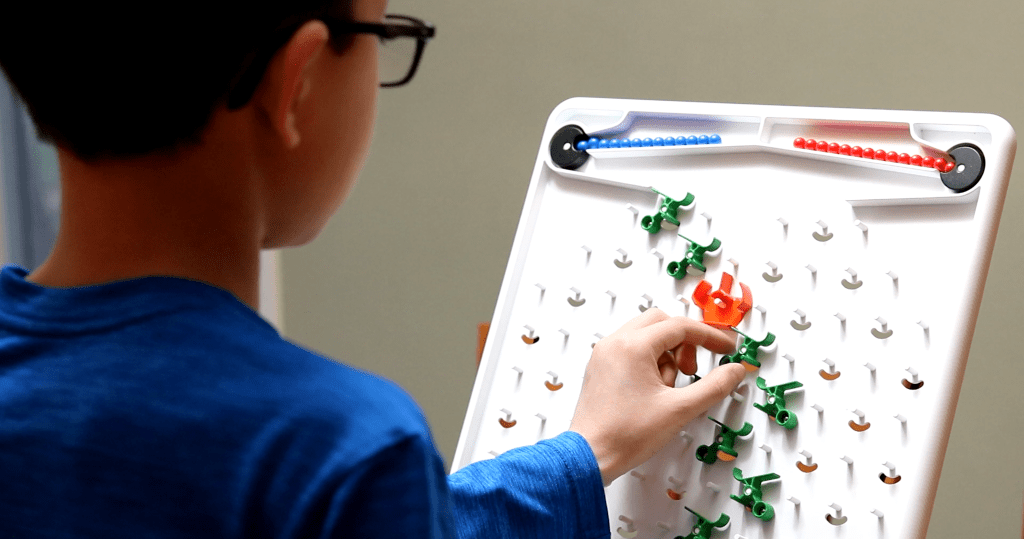

When the lights go out and the entire world is thrust into the technological nether, we’ll need board games like Turing Tumble[1]. Created programmer Paul Boswell – he’s well known for programming complex games for Texas Instruments calculators[2] – and maker Alyssa Boswell, the Turing Tumble lets you use small parts to create logic flows in order to solve puzzles.

Boswell created the game to teach everyone how to program. It rose out of frustration. In his work at the University of Minnesota he found himself stuck with scientists who couldn’t manage programming or computational analysis.

“Programming is a unique skill among chemists and biologists – heck, among just about anyone other than computer scientists – but it shouldn’t be,” he said. “I spent a lot of time teaching my students how to program. There were countless times when I saw other faculty and students pass up good research ideas because they couldn’t make software to do what they needed.”

The game is simple. The a set of marbles roll one at a time from the top of the board through a series of pins and “logic” pieces. When the marble hits a flipper at the bottom it releases another ball – creating a computing cycle.

“Players add logic to the game board by placing six different types of parts onto the board. The ‘Bit’ is a particularly important one. Each time a ball runs over it, it flips to point the opposite direction. Pointing to the left is like a ‘0’, and pointing to the right is like a ‘1.’ Gear bits are the most interesting part, though. Gear bits are just like bits, except that they can be connected to one another so...

Read more from our friends at TechCrunch

The U.S. and other nations with “free market” economies got credit for defeating the communists in Russia. That is ironic, because it is now more clear than ever that western leadership actually shares the Soviet inclination for central planning, and they have been increasingly intervening in our markets since the collapse of the USSR.

Our officials make economic policy as if healthy markets must be planned and coerced, much like the politburo. Some of this policy is created and run in the open; the government bailouts, Quantitative Easing, and zero interest rate policy, for example.

Other programs are more secretive. Investors know the “Plunge Protection Team” exists to be the buyer in markets when all genuine buyers have left. But we can only guess as to what that crew actually does day to day.

What these self-appointed market masters do in complete darkness is likely even more controversial and intrusive. They remain violently opposed to audits and other attempts to impose accountability.

But, recently, some leaked documents have given a sense of what western officials do behind closed doors.

They have actually been micromanaging markets since the 1970s.

Ronan Manly with Bullionstar wrote a terrific piece outlining the coordination among western central bankers pertaining specifically to the gold market after Nixon shut the “gold window” and launched the era of purely fiat currencies.

Wikileaks published a secret memo sent from London to the U.S. Treasury Department regarding the purpose behind the formation of the futures markets for gold.

Officials wanted to create a paper market which dwarfed the physical market and encouraged volatility; all with the aim of discouraging investors from holding bullion. To wit: